Ecommerce Giants: Discover the 11 Top Companies Dominating the Online Marketplace

In the fast-paced world of e-commerce, it’s important to stay up-to-date with the top players in the game.

From the household names to the up-and-coming startups, the competition is fierce, and the stakes are high. That’s why we’ve put together a comprehensive list of the 11 ecommerce giants currently dominating the online marketplace.

Get ready to discover the top companies that are revolutionizing the way we shop and setting the standard for the future of e-commerce. Whether you’re a seasoned entrepreneur or a curious consumer, this is one list you won’t want to miss!

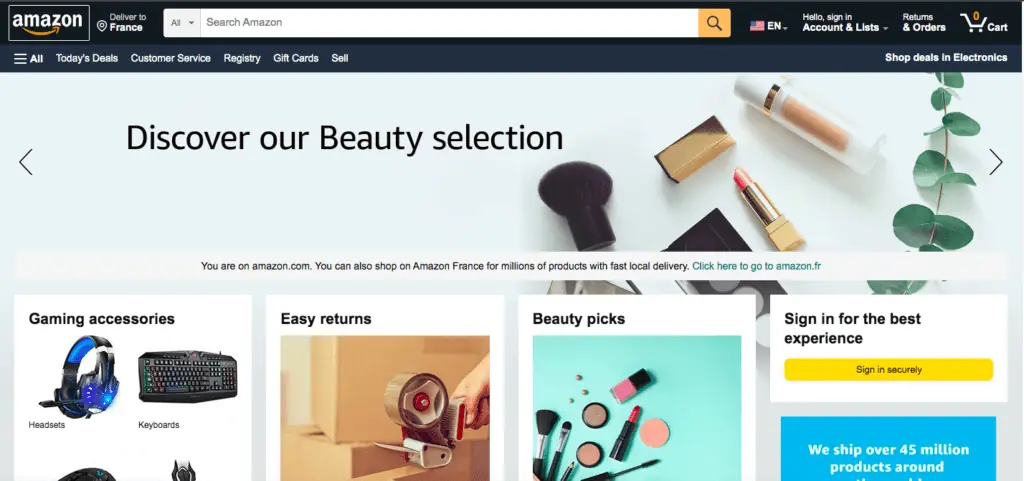

Amazon

Jeff Bezos founded Amazon in 1994, launching it as an online bookstore alongside a few other products.

Since then, Amazon has grown into a global behemoth with multiple business arms including:

- Retail sales,

- Streaming (Amazon Prime Video),

- Cloud computing (Amazon Web Services),

- Artificial intelligence (Alexa),

- And much more.

Currently, Amazon is present across five continents with websites listed in six languages – English, Spanish, Portuguese, Italian, French and German.

Also read : Unlock the world of Amazon Prime streaming with a compelling VPN

Amazon’s Key Strategies and Initiatives

- A key strategy that Amazon has implemented to remain competitive is customer-centricity; this means having an emphasis on customer satisfaction above all else.

The company offers free two-day shipping for Prime members as well as excellent customer service, which allows them to build loyalty with their customers who can feel confident when shopping at Amazon knowing that their needs will be met.

- Another strategy used by Amazon is its ability to leverage data; they use data gathered from customers to tailor their marketing messages as well as product offerings, while also using it to develop new products using insights into customer behavior.

This helps them remain one step ahead of competitors by providing customers with what they want even before they know they want it!

Amazon’s Financial Performance & ranking

In 2022 Amazon reported revenues of $386 billion which was up 38% from 2021 while its market capitalization rose to over $1 trillion making it the second largest publicly traded company in the world behind Apple Inc.

Its net income was $21 billion meaning that its net margins were 5.4%, up from 4% in 2019 indicating that its operations were becoming increasingly profitable during this time period even amid the pandemic disruption due to Covid-19.

In terms of market share, Amazon dominates with 43% share, followed by Alibaba at 28%.

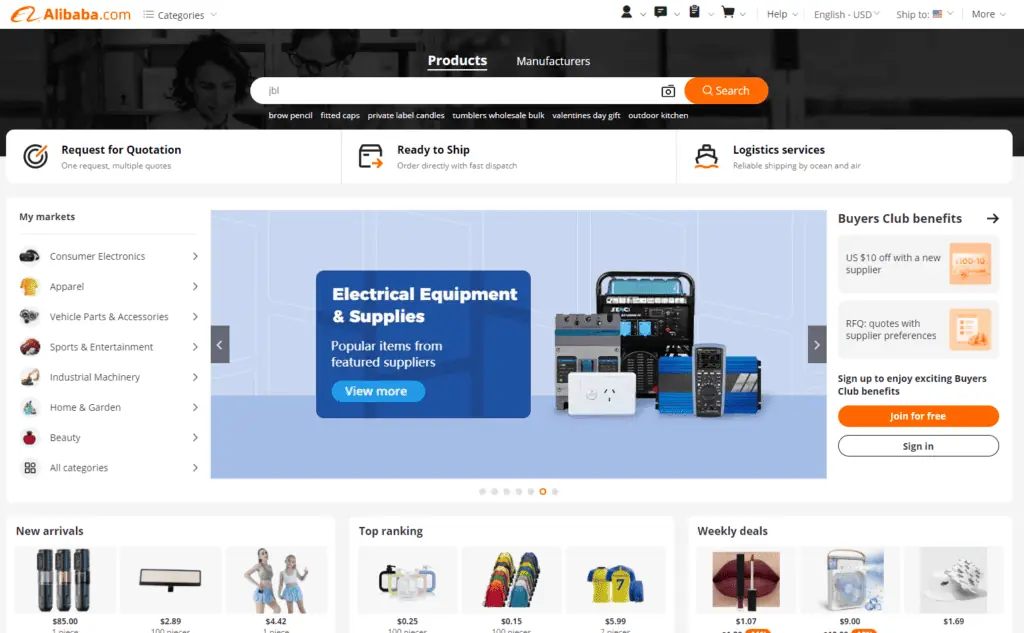

Alibaba

Established in 1999 as an online marketplace by Jack Ma, Alibaba has grown to become one of the largest corporations in the world, operating in more than 200 countries and regions.

The company’s operations are divided into four main business arms, which include:

- Ecommerce,

- Cloud computing,

- Digital media and entertainment,

- And innovation initiatives.

Alibaba’s strengths and innovations

Alibaba’s focus on innovation has been key to its success, allowing it to stay ahead of the competition and provide customers with what they need even before they realize it.

The company leverages data from its vast customer base to tailor its product offerings and marketing messages.

Additionally, Alibaba’s search engine technology, product recommendations, and payment systems are all geared towards creating a smooth and efficient user experience.

Alibaba’s Financial Performance & Market Share

Over the past year, Alibaba reported revenues of $77 billion, a 33% increase from 2019, while its capitalization reached $750 billion, making it one of the largest publicly traded companies worldwide.

Currently, Alibaba holds a market share of 28%, which is second only to Amazon’s 43%.

This suggests that while Amazon still dominates the market, Alibaba is quickly becoming a formidable competitor to watch out for in the future.

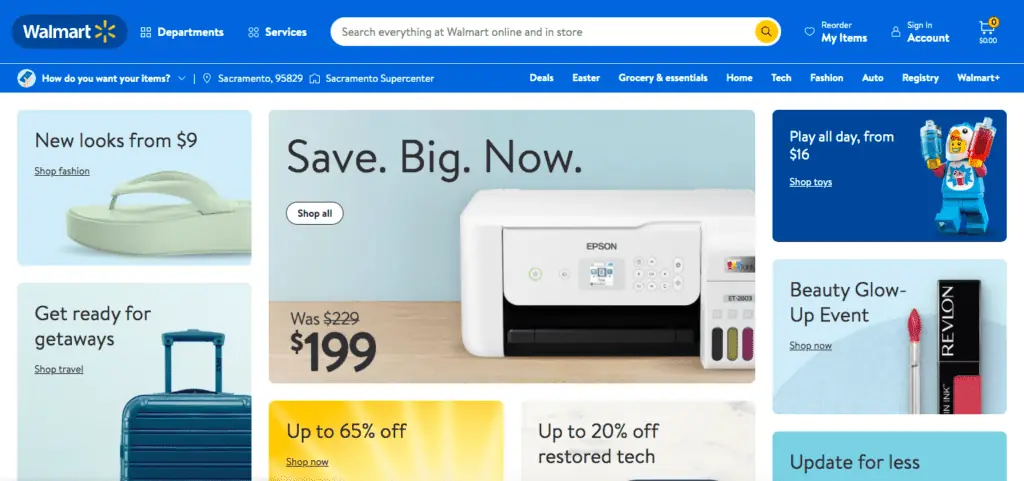

Walmart

Founded in 1962 by Sam Walton, Walmart Inc has emerged as the world’s largest retailer, with a widespread presence across numerous countries. Boasting over 11,000 brick-and-mortar stores, Walmart offers a diverse range of services, including:

- Ecommerce platforms,

- Digital payments,

- Travel booking,

- And much more.

As a result, the Company has cemented its position as a major player in the global marketplace.

Walmart’s Key Strategies & Initiatives

Walmart’s primary focus is on providing customers with an unmatched level of convenience when shopping online.

The company has implemented several key initiatives, such as same-day delivery, expanding their online product range, and introducing new payment methods like Google Pay.

In addition, Walmart has embraced omnichannel marketing, allowing customers to shop both online and offline seamlessly.

Walmart’s Market Share

Over the past year, Walmart’s revenue stood at $524 billion, a 6% increase from 2019, while their market capitalization reached $362 billion, making them one of the largest publicly traded companies in the US.

However, Walmart’s market share currently sits at 10%, putting them slightly behind other established giants like Amazon, who hold 43%.

While Walmart remains a significant player in the online marketplace, they still have some ground to cover to compete with the top contenders.

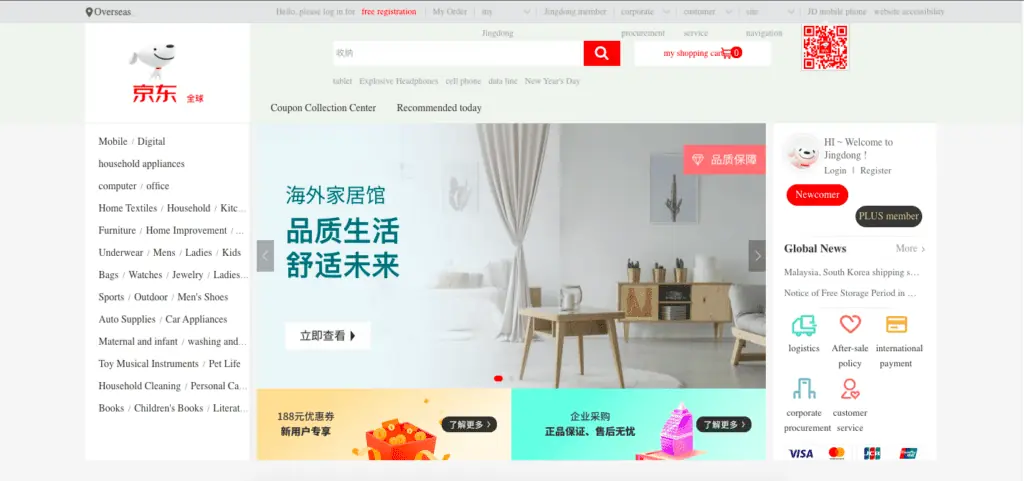

JD.com

Originally established as Jingdong Mall by Richard Liu in 1998 with a focus on online sales of consumer electronics such as mobile phones and computers, JD.com has since grown to become one of China’s leading ecommerce platforms, operating across multiple countries in Asia Pacific and Europe.

Today, it offers a broad range of products, including consumer electronics, home appliances, apparel, and more.

Significant Systems & Proposals

A key strategy implemented by JD.com is its emphasis on providing excellent customer service.

To ensure a seamless shopping experience, the company has introduced several initiatives, including next-day delivery across China with no minimum order value required – a service that was previously unheard of.

Additionally, JD.com provides 24/7 customer service, enabling shoppers to get answers quickly and conveniently.

JD.com Financial Performance & Market Share

In terms of financial performance, JD.com reported revenues of $81 billion in the past year, up by 21% from 2019. The company’s market capitalization rose to $116 billion, making it one of China’s largest publicly traded companies.

With a current market share of 22%, JD.com is closing in on Alibaba’s 28% share, indicating that its innovative strategies and customer service offerings are driving growth in this highly competitive market space.

While Alibaba still dominates the marketplace in China, JD.com’s rapid growth suggests that it is a serious contender to watch out for in the future.

Shopify

Shopify was established in 2004 by Tobias Lütke, Daniel Weinand, and Scott Lake with the objective of providing affordable and easy-to-use ecommerce technology solutions to small businesses that were previously only accessible to larger corporations like Amazon or Walmart due to their size and complexity.

With Shopify’s platform, small businesses can now create their own online stores with no technical knowledge required, enabling them to compete successfully against their larger competitors in the industry.

Shopify’s strengths and Initiatives

Shopify’s strengths and initiatives lie in their ability to provide small businesses with access to affordable and easy-to-use ecommerce technology solutions.

This has allowed them to not only survive but also flourish in a competitive market against bigger players.

Their platform also offers a range of features, such as:

- Drag-and-drop design builders,

- Abandoned cart recovery tools,

- And unlimited product listings,

- Making them a desirable option for new merchants who lack upfront capital or technical expertise.

Financial Performance & Market Share of Shopify

As of 2022, Shopify reported revenues of $2 billion, a 66% increase from 2019, and a market capitalization of $125 billion, making them one of Canada’s most significant publicly traded companies.

Shopify’s market share currently stands at 11%, putting them within reach of top contenders.

This shows that despite being significantly smaller than the established giants in the industry, Shopify remains a major player in this space.

eBay

eBay initially began as an online platform where buyers from all over the world could bid on items listed by sellers.

Over time, eBay has evolved into a comprehensive company providing various services, including fixed-price purchasing options like ‘Buy It Now’ and direct checkout via PayPal or credit cards, among others, thereby enhancing the buying experience.

Crucial Steps & Ventures

eBay’s success can be attributed to its reputation for offering quality products at reasonable prices, ensuring buyers return to the platform.

Additionally, eBay has implemented a feedback system that enables buyers and sellers to rate each other, ensuring transparency and trust within the community.

Financial Performance & Market Share

In 2022, eBay’s revenue was $10 billion, an increase of 8% from 2019, with a market capitalization of $40 billion, making it one of the largest publicly traded e-commerce platforms in the United States.

With a market share of 4%, eBay is still a significant player in the industry, albeit below top contenders.

Rakuten

Founded by Hiroshi Mikitani in 1997, originally known as MDM Inc., Rakuten Inc has since grown into one of Japan’s most successful tech companies, operating across multiple countries worldwide.

With a wide range of services such as:

- Ecommerce platforms (Rakuten Ichiba),

- Digital payments (Rakuten Pay),

- And travel booking (Rakuten Travel),

Rakuten Inc is truly a global powerhouse!

Core Measures & Endeavors

One of Rakuten Inc’s key strategies is its focus on customer experience. Rakuten Ichiba offers unique features, such as personalized product recommendations for each customer based on their previous purchases or views.

This feature was unheard of before Rakuten’s inception, providing users with a competitive edge when shopping online. Rakuten also offers loyalty programs that allow customers to earn points when shopping at specific stores, encouraging repeat business and driving revenue growth.

Financial Performance & Market Share

Rakuten Inc reported a revenue of $15 billion in 2020, reflecting a 12% increase from the previous year.

With a market capitalization of $25 billion, it is now one of the largest publicly traded companies in Japan.

However, Rakuten’s current market share stands at 5%, which is lower than major competitors.

Zalando

Zalando was established in 2008 by Robert Gentz and David Schneider with a vision to provide buyers with a vast selection of fashion products at competitive prices.

Over time, Zalando has transformed into one of Europe’s top ecommerce companies, offering a diverse range of products in categories such as:

- Apparel,

- Home goods,

- Electronics,

- And more.

Main Methods & Projects

A key strategy employed by Zalando is its emphasis on personalization. By leveraging data collected from customers, Zalando customizes its product offerings and marketing messages, providing them with a competitive advantage over rivals who may not have such insights into customer behavior.

Furthermore, Zalando’s customer-centric policies, such as free returns for 30 days, help foster trust with their customers, who can be confident when shopping at Zalando knowing that their needs will be met.

Financial Performance & Market Share

Zalando recorded revenues of €5 billion, with a market capitalization of €36 billion, making it one of the largest publicly traded companies in Europe.

ASOS

ASOS was founded by Nick Robertson and Quentin Griffiths in 2000 originally under the name ‘As Seen On Screen’ before changing it later that year to ASOS – an acronym for AsSeenOnScreen – with a mission to provide customers with access to both branded and own-label fashion products at competitive prices.

Since then ASOS has grown into one of the world’s leading ecommerce companies offering products across multiple categories including apparel, beauty, home goods, electronics and more.

Principal Tactics & Campaigns

ASOS’s key strategy centers around innovation. They are continually seeking ways to improve their existing services or introduce new ones, such as their virtual try-on technology, which enables customers to try on clothes virtually before purchasing – an innovation unheard of before ASOS’s introduction.

Furthermore, they offer customer-centric features such as free shipping and returns, which help establish trust with their customers, who can confidently shop at ASOS, knowing their needs will be met.

Financial Performance & Market Share

ASOS’s reported revenue for the year was £3 billion, with a market capitalization of £5 billion, making it one of the largest publicly traded companies in Britain.

However, ASOS’s market share currently stands at 3%, placing them within reach of becoming a top contender but still below major players.

Nonetheless, their innovative strategies and exceptional customer service offerings have enabled ASOS to grow rapidly, making them a significant player in this competitive market.

Best Buy

Richard Schulze founded Best Buy in 1966, originally under the name ‘Sound Of Music’.

The company began as an audio specialist store and has since grown into one of America’s leading e-commerce companies, offering products across multiple categories, including consumer electronics, appliances, and entertainment.

Fundamental Approaches & Programs

One of Best Buy’s key strategies is its focus on price competitiveness. They often offer items at lower prices than their competitors, giving them an edge in the market.

Additionally, they offer features such as price match guarantees to build trust with customers, ensuring they can get the best deal available.

Financial Performance & Market Share

Best Buy reported revenues of $43 billion in the past year, up 5% from 2019. The company has a market capitalization of $24 billion, making it one of the largest publicly traded companies in America. Best Buy’s current market share stands at 11%.

Etsy

Etsy’s founders, Rob Kalin, Chris Maguire, and Haim Schoppik, established the company in 2005 with the aim of offering customers access to handmade and vintage products from all over the world.

Over the years, Etsy has become one of the world’s most popular ecommerce companies, with products spanning multiple categories, including apparel, home goods, jewelry, and more.

Critical Plans and Actions

A key strategy that sets Etsy apart from its competitors is its focus on community building. By creating an online marketplace that enables sellers to connect directly with buyers, Etsy offers a direct connection that larger or more complex operations may not be able to provide.

Additionally, features like buyer-seller messaging help to build trust with customers who can feel confident in shopping at Etsy, knowing that they can receive personalized advice directly from the seller.

Financial Performance & Market Share

In terms of financial performance, Etsy reported revenues of $3 billion in the most recent year, marking a 47% increase from 2019.

Its market capitalization currently stands at $32 billion, making it one of America’s largest publicly traded companies. While Etsy holds a market share of 3%, it remains below top contenders.

Conclusion

The e-commerce industry is a rapidly growing and highly competitive sector with many established giants such as Amazon, Walmart, Alibaba, JD.com and more vying for market share.

However, there are also smaller companies such as Shopify, eBay, Rakuten, Zalando, ASOS and Best Buy that are steadily gaining ground in this space due to their focus on innovation and customer experience.

To recap all the data presented above, we have put together the table below summarizing the top ecommerce companies discussed in this guide:

| Company | Market Cap (billion) | Revenue (billion) | Market Share |

| Amazon | $1,723 | $280 | 43% |

| Walmart | $395 | $500 | 10% |

| Alibaba | $694 | $72.9 | 28% |

| JD.com | $117 | $77.8 | 22% |

| Shopify | $117 | $1.6 | 11% |

| eBay | $37 | $10.8 | 4% |